- Ihsedu Agrochem Pvt. Ltd.

- Ihsedu Speciality Chemicals Pvt. Ltd.

- Ihsedu Coreagri Services Pvt. Ltd.

- Ihsedu Itoh Green Chemicals Marketing Pvt. Ltd.

Ihsedu Agrochem Pvt Ltd is a non listed materially significant subsidiary of Jayant Agro Organics. Ihsedu networth and sales make up more than 20% of Jayant Agro Organics consolidated networth and net sales..

Similarly Ihsedu Speciality Chemicals Pvt Ltd is a non listed materially significant subsidiary of Jayant Agro Organics as Ihsedu Speciality Chemicals Pvt limited "networth" is more than 20% of consolidated networth of Jayant Agro Organics.

For year ending March 2011.

Standalone profits for Jayant Agro was: 17.21Cr

Consoldiated profits for Jayant agro was: 24.57Cr

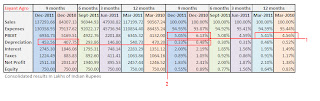

Considering the facts that Jayant has 2 subsidiaries which are materially significant its always adviseable to look at the consoldiated numbers.. So lets look at the latest consoldiated numbers..

1. On a Year-on-Year basis the numbers are great..

Sales up: +62.85%

PBDIT up: 34.15%

Taxes up: 38.54%

Net Profit up: 23.60%

- Volume driven performance..

- Costs have increased decreasing margins

- Taxes paid at 32% of PBT is good.

These numbers are great ..specially if you consider the fact that March 2011 (24.57cr) net profits were 97.14% higher than March 2010 (12.46cr) net profits.So this increase is over a higher base..

Jayant Agro Organics with a profit of 25.11cr has exceeded last year's profits within 9 months of this financial year.

Sales are doing great lets look at the margins..

1. Margins on a Year-on-Year basis is down 108 basis points (ie. 1.08%) from 6.13% to 5.05%

most likely we might see margins drop to 2010 levels of 4.56% (unless the new derivatives business really increases the profit margins)

2. Depreciation as a percentage of sales is down.. while on absolute numbers it is still increasing..

3. Interest payments at 2% of sales is right on the dot to take advantage of the 2% interest subsidy scheme of govt of india for exporters. (so expect higher debt levels ..)

Strong topline growth .. is an indication of Jayant's growing position within the castor oil and derivatives business. Margins are stable at 5-6% PBDIT.. with the castor derivatives plant in place .. we should see higher margins..(Watch out for that)

Segmented results is not for the consolidated entity.. hence does not make sense to compare them.

Conclusion: Jayant Agro Organics is growing consistently.. profits are still very low with 2% net profit margins.. Derivatives plant's first full quarter of operations is going to be Jan-March 2012 and something to watch out for improvement in margins.. Pls note as per management derivatives will add around 200-250cr (annually) to the topline so donot expect sharp increase in topline based on new castor derivatives business. I would continue to hold Jayant stock for now due to improving business climate (peak oil, bio-renewables demand)

4 comments:

Dear Whatsup,

Thanks for the analysis.At the present market condition, Jayant is still a hold only or can we add more??I already have some shares of Jayant around 90 levels. Will it be another Venkys if your peak oil theory comes true... Thanks

Anonymous:

The current environment is already the beginning of post oil economy..

one glaring example is Reliance .. though reliance is not cheap even at these prices..

Saudi aramco moving into producing petroleum products (diesel,petrol and even plastic ingredients) instead of raw crude .. shows that margins are falling..

hence the move by reliance into 3G/telecom..

get a leg into tata communications.. its a must have..

you can add jayant also at below 90 levels ..

=happy investing

whatsup-indianstockideas.blogspot.com

Anonymous:

at current market cap of 142cr (cmp:95) jayant is a 1800-2000cr sales company..

so a market cap of around 500cr (250% price increase from cmp ) is not far fetched

you can accumulate but then.. I feel the stock will fly only if it crosses 110 ..

so buy above 110 ..else wait for below 90 levels to buy..

=happy investing

whatsup-indianstockideas.blogspot.com

Dear Whatsup, Thanks for the reply.I will add some more Jayant. Tata comm, I am bit reluctant becoz of the higher stock price. Many midcaps are available at low PE. Regards.

Post a Comment