Saturday, December 26, 2009

Update Venkys India

Venkys India: CMP: 239 Market Cap: 224.46Cr

52 Week High : 285 52 Week Low: 65

Venkys India has recently scaled its new 52 Week high (285). The question in our mind is:

1. Do you continue to hold?

2. Is this a good price to buy?

Suggestion: Venkys is still a fundamentally good story.

- It's market capitalisation is still 0.5 times sales probably because of its "Non Vegetarian" outlook. Company is not in a commodity business as people think. It provides value added inputs to hatcheries by providing chicks, broiler and layers, Poultry feed, Poultry Vaccines, Health Food Supplements,

- Promoters have been buying from the open market at prices of 140-160 levels. Promoters would expect more than 200% appreciation in long term.

- Venkys India has close to 54Cr invested in mutual funds and has 10Cr worth of Cash and Cash equivalent and generated 6 Cr of other income (last year 5.22Cr)

- Inventories worth 70Cr

Current Worth = Market Cap + Debt - (Cash + cash equivalents)

Current Worth = 224.46 + 93.89 - 64 = 254.35Cr

Total income Twelve Trailing Months = 634.83Cr

Tyson one of the largest players in the world in processed chicken has tied up with Godrej. Venkys has been avoiding direct entry into the local fresh chicken broiler market but with entry of players like Tyson, Venkys has to decide what is it future growth strategy.

Venkys also has SPF (Specific Pathogen Free) Egg capacity. Serum institute of India one of the largest Vaccine manufacturer in the World has 1% stake in Venkys.

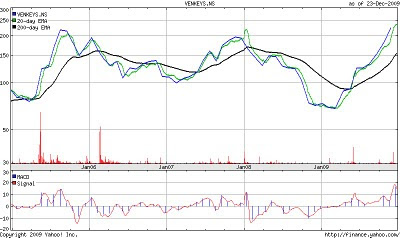

Technically there will be a drop in the stock price, it would be good to accumulate stock slowly in venkys around 170-200 levels (close to promoter buying level) Holders who have bought at lower levels can book some profit at these levels.

Stocks generally over shoot both on upside and downside. We have not yet heard of any positive news flow with regards to Venkys (which is when its best to sell the stock)

Decision: Hold, as further gains should be there in this stock. Investors with holdings at lower levels in large quantities could sell 30-40% stake to reduce their cost of holding to close to zero. It also will provide you the cushion to buy more at dips. More buying should be done at close to 170-200 levels. Investments can also be done on Best Buy recommendations

PN: These are my personal views please do your own deep dive before investing.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment