Currently, nanoparticles (NPs) are used in several scientific applications, but among these silver nanoparticles (Ag-NPs) are predominant. This is because of several characteristic features of this type of metal NP.

Antimicrobials and nanocomposite fabrication are some of the highly useful applications, among others, of applications that were attributed to Ag-NP.

In the fabrication of NPs, it is very important to control particle size, shape, and morphology.

Laser ablation in liquid media is a simple and clean method for synthesis of NPs.

In this technique, there is no need to use any chemical reagents (such as NaBH4) in the fabrication process or any purification techniques to characterize the produced NPs.

Conclusion:

Ag-NPs have been successfully prepared in castor oil by laser ablation from a silver plate. The results obtained showed that the produced Ag-NPs were well dispersed and also stable

for quite a long period of time. This ability of castor oil to prevent agglomeration of Ag-NPs is due to the presence of long-chain hydrophobic moieties.

Link to Original article

Jayant agro Archives:

Wednesday, March 30, 2011

Wednesday, March 23, 2011

Company: Jayant Agro Organics: CRISIL Report March 2011

I must thank Purushottam for sharing this link about CRISIL Report for Jayant Agro:

Page 1:

Page 2:

Page 3:

Page 4:

Conclusion:

The great part is that the report has been published in March 2011 so its latest report. The only thing I think worth adding to this is the fact that Jayant agro has only 6045 shareholders (link)as of Dec 2010 so the number of shareholders are pretty concentrated and availability of free stock is very low with a surge in demand we can expect Jayant price to spike for sure..

Thursday, March 10, 2011

Jayant Agro: Castor Oil derivatives used in Solar panels

One more futuristic uses of "Castor": Reduce cost and also make Solar Panels environment friendly

The purpose of this casing "Back Sheet" is to Protect the Panel, Keep the moisture out and provide a certain electrical value so that solar panels can generate electricity in a conventional manner.

A typical "Back Sheet" uses 8 different layered components. BioSolar will replace the structure with one layer of bio-based material derived from castor bean oil.

"We buy the resin—a castor bean based nylon 11 resin—and formulate it by mixing other ingredients to enhance its properties. The new product increases its resistance to water and becomes more insulating, and more affordable. We call the product, ‘BioBacksheet.’"

BioBacksheet achieves all three goals for photovoltaic solar panel manufacturers through guaranteed longtime durability, cost savings and the introduction of more green material.

Conclusion: Castor Oil is a Natural Oil Polyol-There is no substitute in nature for its unique Biochemical structure. Modification of the Molecular Structure by dehydration yields a unique drying oil-that is superior to any other vegetable oil. Castor Oil Derivatives are unique to high performance greases and cannot be substituted. Castor Oil and Castor derivatives are Bio-Renewable, Bios sustainable. Buy Jayant Agro Organics one of the largest players in processing of Castor oil in India. India is the largest exporter of Castor oil in the world with 90% of all exports originating from India.

PN: Link to the original article

Archives on Jayant Agro

Monday, March 07, 2011

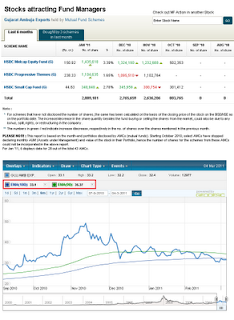

GAEL: HSBC Mutual fund buying into GAEL

Looks like there is accumulation by HSBC mutual fund into GAEL ..

at 32 bucks that is 9.24Cr worth of cash into GAEL.. in past 6 months.. WOW!!

Also the 180 days(6 months) and 90 days (3 months) avg prices are 33.1 and 35.37.

(link to original source in moneycontrol)

Conclusion: This is a great price.. and we are seeing acknowledgement from professionals like HSBC mutual fund.. since they have bought for more than 1 fund which means that its an identified stock by the fund house.

Thanks Purushottam for the follow up and sharing the info with everyone on this blog.

Wednesday, March 02, 2011

Margin Call on Promoters!! Buy SKM Egg

SKM Egg:

CMP: 10.60

Market Cap: 27.67Cr

Sales TTM (Twelve tariling Months): 162.73Cr

Gross Profit TTM: 3.02Cr

Net Profit: -ve 11.82Cr

Interest Payment TTM: 7.26Cr

Depreciation TTM: 7.56Cr

=================================

Scavengers on the Street are fishing for a little piece of information. Something that may appear innocuous, but isn't. Unsuspecting individuals who share it may not anticipate the havoc it can cause. Till the stock market opens the next day. A slice of the information can be accessed from the Internet. The more damaging part is with someone else. The scavenger's job is buying that 'someone' a drink. It's about pledged shares. Not the number of shares that promoters of mid-cap companies have pledged with loan sharks to raise money. That information is in public domain. But what isn't is the price at which a lender pulls the trigger. A short seller who comes to know that price hits the goldmine.

If the stock that's pledged slips below this price or even touches it, the lender will ask the borrower to either pledge more shares or bring in cash. It's called margin call — a dreaded term in the market. If the borrower can't, the lender dumps the stock. An unnerving sequence of events may follow: as the stock falls further, the lender asks for more margin, and as the borrower fails, there's more selling. Indeed, a scavenger who knows the price at which the margin call will take place is the master of the situation.

Once he fishes out that information, he plans for the kill. Before that, some homework has to be done. He must be sure that the promoter who has borrowed doesn't have spare cash or shares to cough up. If he figures out that the borrower is stretched to the limit, he starts going short on the stock. If the price drops to a point where it's at a striking distance to the price at which the margin call will be triggered, he shorts again for the one last time. A small push, before a free fall.

If the lender is a high-street bank and the borrower a big name who has been a client for years, the outcome can be less brutal. But when the borrower is a mid-cap dream-seller and the lender a new-generation finance company or a brokerage arm, there is unlikely to be a prolonged parlay. The scavengers know it all too well.

What has come to their advantage is the comparatively easy access to the 'price info'. Their analysts can chat up with company officials to find out the name of financiers, and others can follow it up with lenders to 'get a sense', as they say, about the price, or at least the range at which margins can be called. In several cases, such queries could even pass as academic interest — a ploy that bond houses once used in a different way. Treasury economists in Mumbai bond desks called up their counterparts in the labour ministry to have a serious conversation about the 'inflation scenario'. Such chats, on a Wednesday evening, inevitably ended with the latter disclosing the inflation number that will be announced on Friday morning. On Thursday, bond traders knew how to use the information. Those were the days when the stock market never cared about weekly inflation numbers. And the world outside Nariman Point was clueless about bonds. It was a neat arrangement that went on for years till too many people started trying it out.

The scavengers in the equity market are still a small group. They prey on small companies backed by cash-starved promoters. Shaky fundamentals about the stock and a bad press on the company do not govern their action, even though such things make their job easier. They are unlikely to touch stocks where the promoter is not leveraged, even if there are enough fundamental reasons to short the counters.

Some of these scavengers had cut a very different deal with company promoters in the heady days of 2007 when every penny stock was up for grabs. That was a time when friendly promoters used them to rig up stock prices before shares can be dumped on foolish late-comers. Today, the promoters are at the mercy of the same people — their one-time partners in crime. In the quicksands of the market, the balance of power has shifted. In an unforgiving Dalal Street, what goes around comes around.

============================

Here is the link to the original Economic Times Article (Link)

============================

A more important question is.. can we identify these stocks and take advantage of the situation?.

we do have one stock in our back yard which seems to face this problem (SKM Egg)

============================

Promoter pledged shares in March 2009: 7,899,000

Total shares held by promoters in March 2009: 14,028,893

% of shares pledged: 56.30%

============================

Promoter pledged shares in Dec 2010: 11,242,492

Total shares held by promoters in Dec 2010: 11,744,513

% of shares pledged: 95.7% << Alarm Bells!!

============================

Let us look at SKM Debt levels:

Long term Debt to Equity ratio is: 0.79 for year ending March 2010

Short term Debt/Equity ratio is: 1.49 for year ending March 2010

Lets look at interest payments:

Interest PaymentsYear ending March 2010: 8.12Cr

Interest payments for past 9 months: 6.33Cr

so certainly SKM has kept the interest payments in control.

The stock definitely seems to have been hit by scavengers as we can see the promoter pledged shares are more than 95% and any further drop could coincidently trigger a fire sale by the lender.. kicking the promoters out and put the "scavengers" in the driver seat.

Well what's in there for us?. I would say.. a really low price to get in cheap into SKM Egg as the scavengers try to push the stock down.. 52 Week low is: 9.15 on BSE Feb 11,2011 current market cap of: 27.67Cr for the largest exporter of "Egg Powder" from India .. is Cheap Real Cheap..

In the past history of 13 years the Avg "Cash Flow from Operations" for SKM egg is +ve 2.77Cr

Conclusion: This is crunch time.. but its actually an opportunity to get in real cheap into SKM Egg. Company is fundamentally sound and we can expect the company to do well in the future.. Scavengers are on the prowl giving us an opportunity to get in cheap. The stock last fell below 10 bucks in July 30,2004. which means even during the carnage of 2008-9 SKM did not touch 10 bucks.. Current stock price is a great buy price

Shareholding with pledged share data of promoters March 2009 and Dec 2010

SKM Egg share price drop below 10 on July 30,2004

Tuesday, March 01, 2011

Indian Budget 2011-12

The Indian Union Budget is in our face. The official Govt website where you can get original info along with the economic survey 2010-11 data is here (link)

Indian economy is on a roll and will continue to do so. The youngest working age population in the world ensures India of a strong internal demand for goods and services. Global activities could be the only source for derailment of the Indian story. Here Oil price as well as capital inflows/outflows is what is of prime concern.

My area of investment is targeted on Agro processing (GAEL and Jayant) and energy efficiency (NHPC and Tata Communications)

NHPC which is a largest hydro electric power company in India and since its public sector enterprise has vast experience and access to restricted area's of the nation to setup hydro power plants. With fuel linkages a priority NHPC has the natural Water cycle as its source of fuel which is a big advantage. The govt is no longer shy to charge market rates for power and this is going to benefit large scale producers who have their input costs capped. As fuel prices rise .. hydro power electricity and coal powered electricity will be charged the same rates and we will see NHPC benefit from these actions in the future.

Tata Communications: Its sitting at the junction of the world wide web with the largest submarine cable network in the world. So everytime you google in India or any other country in the world you are paying Tata Communications. Now with 3G rollout in India and other countries bandwidth utilization is going to rise and so will the profits of tata communications.

Jayant Agro and GAEL: We have been concentrating on Agro based industries and with govt emphasizing on agri-infrastructure we could see GAEL and Jayant take advantage of the same (storage godowns). GAEL has a Debt/Equity Ratio of 0.42 and Long term debt equity ratio of 0.03 so is well placed for future expansions. Jayant has a Debt/Equity ratio of 2.1 and long term debt equity ratio of 0.42. So Jayant already has carried out expansion in terms of the new JV which is keeping its debt levels busy.

Conclusions: GAEL, Jayant, NHPC and Tata Communications are the core holdings one must own Recommended (Best Buy). All are available at fair/discount valuations and are future ready. Current downturn is a great opportunity to add more on all these counters.

Subscribe to:

Posts (Atom)