CRISIL has upgraded its ratings on the bank facilities of Jayant Agro-Organics Ltd. (JAOL; part of the Jayant group) to ‘CRISIL BBB/Stable/CRISIL A3+’ from ‘CRISIL BBB-/Stable/CRISIL A3’.

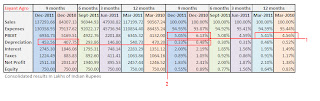

The upgrade reflects more-than-expected improvement in the Jayant group’s financial risk profile, driven by sizeable cash accruals, in 2010-11 (refers to financial year, April 1 to March 31). The group reported a significant growth in revenues for 2010-11 and for the first half of 2011-12 and has maintained its operating profitability over the past five years leading to healthy cash accruals and accretion to reserves. The group’s revenues increased by 30 per cent year-on-year in 2010-11 and by 65 per cent in the first half of 2011-12 over that in the first half of 2010-11. Its turnover is expected to increase at a healthy rate over the medium term, driven by healthy global demand, increase in castor seed prices and the group’s position as the largest organised player in the castor oil industry. The upgrade also factors in expected improvement in the group’s operating profitability because of commencement of operations at group company Ihsedu Speciality Chemicals Pvt Ltd (ISCPL) in December 2011.

The ratings continue to reflect the Jayant group’s leadership position in castor oil and castor-oil-based derivatives business, supported by its promoters’ longstanding industry experience, and the group’s healthy operational efficiencies, aided by its integrated operations and healthy working capital management. These rating strengths are partially offset by the group’s moderate financial risk profile, marked by modest operating margins, volatile working capital requirements, high gearing and susceptibility to risks related to stabilisation of operations at ISCPL.

To arrive at its ratings, CRISIL has combined the business and financial risk profiles of JAOL, and JAOL’s wholly owned subsidiaries, Ihsedu Agrochem Pvt Ltd (IAPL), Ihsedu CoreAgri Services Pvt Ltd (ICSPL), and ISCPL, and Ihsedu Itoh Green Chemicals Marketing Pvt Ltd (IIGCMPL; JAOL’s joint venture with Itoh Oil Chemicals co Limited. The entities are collectively referred to as the Jayant group. All the group entities have significant operational and financial linkages with each other. JAOL has provided corporate guarantees for the bank facilities of ISCPL and IAPL.

Outlook: Stable

CRISIL believes that the Jayant group will maintain its healthy market position in the castor oil and castor-oil-based derivatives business over the medium term, supported by expected stabilisation of operations at ISCPL. The outlook may be revised to ‘Positive’ if the group demonstrates a track record of stable operations at its sebacic acid plant coupled with a significant improvement in its capital structure over the medium term. Conversely, the outlook may be revised to ‘Negative’ if the group undertakes a larger-than-expected debt-funded capital expenditure (capex) programme or if its working capital requirements increase beyond expectations, thereby adversely impacting its capital structure.

About the Group

Set up in 1992, JAOL manufactures castor oil and castor-oil-based derivative products. Its promoters have been in the castor oil business since 1952, when they set up Jayant Oil Mills. Following the separation of the Kapadia and Udeshi promoter families, in 2002, the Udeshi family started running the business under JAOL.

IAPL was set up as a backward integration initiative into seed-crushing in 2001-02. It has a seed crushing capacity of 360,000 tonnes per annum (tpa) and cake crushing capacity of 210,000 tpa.

ISCPL was set up in 2006 as a joint venture of JAOL and Mitsui & Co. Ltd, Japan. In August 2011, JAOL bought all the shares of ISCPL, making it a wholly owned subsidiary. ISCPL is engaged in manufacture of sebacic acid, a castor-oil-based derivative, and has commenced commercial production in December 2011.

ICSPL was set up to manufacture hybrid seeds. It has generated revenues of Rs.20 million in 2011-12.

IIGCMPL was incorporated in 2010-11, with JAOL holding 90 per cent equity stake, which has now reduced to 60 per cent. IIGCMPL has not begun operations yet.

The Jayant group reported a profit after tax (PAT) of Rs.249.2 million on net sales of Rs.12.56 billion for 2010-11, against a PAT of Rs.124.6 million on net sales of Rs.9.03 billion for 2009-10.

Image of the rating report: