Wednesday, December 30, 2009

Gujarat Ambuja Exports

August 30,2011:GAEL: Promoters buy 10,000 shares from Market @ 23.08 on August 26,2011

August 30,2011: GAEL: 1MW Bio Gas Plant in Uttarakhand (Maize Starch waste)

August 30,2011: GAEL: 1MW BioGas Plant in Himmatnagar (maize starch waste)

August 27,2011: Gujarat Ambuja Exports: June 2011 Quarterly Result Review

August 16,2011: Gujarat Ambuja Exports: Ready Steady GO!!

July 18,2011: Gujarat Ambuja Exports: Year End March 2011: Review

May 21, 2011: Gujarat Ambuja Exports: MoneySights Rating: Strong Financials, Strong Upside

May 21,2011: Gujarat Ambuja Exports: Foreign Funds invested in Gujarat Ambuja Exports

April 14,2011: Gujarat Ambuja Exports: March 2011 Shareholding data

March 7,2011: Gujarat Ambuja Exports: HSBC Mutual fund buying into GAEL

Feb 8,2010: Gujarat Ambuja Exports: Company Product Video and Client List (Very Very Important)

Feb 2,2011: Gujarat Ambuja Exports: Dec 31,2010 Quarterly Results Segmented Data

Feb 1,2011: Gujarat Ambuja Exports: Dec 31,2011 Quarterly Results Review

Jan 14,2010: Gujarat Ambuja Exports: CRISIL Rating upgrade Jan 2011

Jan 14,2010: Gujarat Ambuja Exports: Dec 31,2010 shareholding review

Dec 1,2010: Gujarat Ambuja Exports: Dalal Street Journal Article

Oct 25,2010: Gujarat Ambuja Exports: Promoter Guidance for Year 2011

Oct 25,2010: Gujarat Ambuja Exports: Sept 2010 Quarterly Result Review

Oct 14,2010: Gujarat Ambuja Exports: Sept 2010 Shareholding Report

Oct 12,2010: Gujarat Ambuja Exports: Sept 2010 Qtrly results on Oct 23,2010

Sept 26,2010: Gujarat Ambuja Exports: Hold on to your cheap stocks

August 31,2010: Gujarat Ambuja Exports: Promoters buy 53,506 shares in August 2010: Annual Report 2010

August 13,2010: Gujarat Ambuja Exports: Promoter Buying SAST Disclosure August 10-11, 2010

August 4,2010: Gujarat Ambuja Exports: June 2010 Quarterly Result Review: Strong Buy!

July 17,2010: Gujarat Ambuja Exports: Announcement: Strong Buy!!

July 14,2010: Gujarat Ambuja Exports: Review: Shareholding as of June 2010

June 7,2010: Gujarat Ambuja Exports: Promoter buying from Open Market Jun 1,2010

April 28,2010: Gujarat Ambuja Exports: March 2010 Quaterly and Annual Result review

April23, 2010: Gujarat Ambuja Exports: What is the Ideal price for GAEL

April 16, 2010:Gujarat Ambuja Exports: Sharebuyback Jan 15,2008 Avg Price 34.26

April 14,2010: Gujarat Ambuja Exports: Review

June 01,2009: Gujarat Ambuja Exports: Deep Value

Dec 25,2009: Best Value Buy

Gujarat Ambuja Exports - Website (updated)

Annual Report March 2009 (updated)

Annual Report March 2010

Annual Report March 2011 (New Link)

Labels:

GAEL,

Gujarat Ambuja Exports,

Value investing

Tuesday, December 29, 2009

Pitti Laminations: Deep Discount: Indirect Power Play

Pitti Laminations:

CMP: 34 Listed on: BSE/NSE

Market Cap: 32.22Cr Sales: 267Cr (March 2009) Pitti Home Page

Pitti Laminations manufactures electric grade steel stampings and laminations up to a diameter of 1300 mm (51”) for application in Industrial motors, DC Machines, Alternators, Traction Motors, Pumps, Train lighting generators, Aeronautics, Medical diagnostics equipments, Windmill generators, Laminations for specialised applications, Die-Cast Rotors, Assembled Stators and Built-up Rotors.

Company has increased its manufacturing capacity from 10,000MT to 25,000MT.

It has a large customer base in India and abroad like ABB, BHEL, Siemens, Crompton Greaves, Areva T&D, VATECH, Bharat Bijlee, Kirloskar Brothers, Suzlon, GE(US), KSB Pumps, Otis Elevator Company, Toyo Denki Power Systems, Welco Technologies(US), DOL Motors Private Limited, PILLER Power Systems, Wittur, DK Rewinds.

Pitti Laminations has also set up value added facbricated steel Stator Body capacity of 3000 Nos per annum.

Recommendations: Strong buy at these levels since Pitti Laminations is an indirect play on the power infrastructure story of India. Divident return is also a healthy 2.9% (10% divident) but long term divident return is 5% which is great.

Strategy: Buy now at these levels and with improved fundamentals in next year we can expect it to be a multibagger.

Gammon: Bridge Collapse Accumulate

Just look at the accumulation happening at 220 for Gammon 1st trading day after bridge collapse.

NHAI has given a clean chit to GAMMON.

GAMMON has built the maximum number of bridges in India. Gateway of India has been built by Gammon and here you have the company selling at 0.5 times sales!! STRONG Buy

Saturday, December 26, 2009

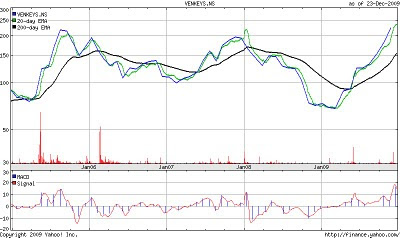

Update Venkys India

Venkys India: CMP: 239 Market Cap: 224.46Cr

52 Week High : 285 52 Week Low: 65

Venkys India has recently scaled its new 52 Week high (285). The question in our mind is:

1. Do you continue to hold?

2. Is this a good price to buy?

Suggestion: Venkys is still a fundamentally good story.

- It's market capitalisation is still 0.5 times sales probably because of its "Non Vegetarian" outlook. Company is not in a commodity business as people think. It provides value added inputs to hatcheries by providing chicks, broiler and layers, Poultry feed, Poultry Vaccines, Health Food Supplements,

- Promoters have been buying from the open market at prices of 140-160 levels. Promoters would expect more than 200% appreciation in long term.

- Venkys India has close to 54Cr invested in mutual funds and has 10Cr worth of Cash and Cash equivalent and generated 6 Cr of other income (last year 5.22Cr)

- Inventories worth 70Cr

Current Worth = Market Cap + Debt - (Cash + cash equivalents)

Current Worth = 224.46 + 93.89 - 64 = 254.35Cr

Total income Twelve Trailing Months = 634.83Cr

Tyson one of the largest players in the world in processed chicken has tied up with Godrej. Venkys has been avoiding direct entry into the local fresh chicken broiler market but with entry of players like Tyson, Venkys has to decide what is it future growth strategy.

Venkys also has SPF (Specific Pathogen Free) Egg capacity. Serum institute of India one of the largest Vaccine manufacturer in the World has 1% stake in Venkys.

Technically there will be a drop in the stock price, it would be good to accumulate stock slowly in venkys around 170-200 levels (close to promoter buying level) Holders who have bought at lower levels can book some profit at these levels.

Stocks generally over shoot both on upside and downside. We have not yet heard of any positive news flow with regards to Venkys (which is when its best to sell the stock)

Decision: Hold, as further gains should be there in this stock. Investors with holdings at lower levels in large quantities could sell 30-40% stake to reduce their cost of holding to close to zero. It also will provide you the cushion to buy more at dips. More buying should be done at close to 170-200 levels. Investments can also be done on Best Buy recommendations

PN: These are my personal views please do your own deep dive before investing.

Friday, December 25, 2009

Best Value Buy:

Current Best Value Buy according to me is "Gujarat Ambuja Exports" (Dec 25,2009) and here are the reasons.

CMP: 23, Market Capitalization: 317.52Cr

1. Company buyback in 2008 avg price 34.5 per share buyback worth 3.31Cr.

2. As per SEBI Guidelines buyback can be done with only 10% of free reserves so GAEL had 331Cr of free reserves in 2007-2008. current market cap is 317Cr

3. Promoters have been increasing stake by buying stock from the market.

4. Promoters have bought 1,98,256 shares from Jan 2009 to June 2009. Price range is 13 to 36 for the period Jan 2009 to June 2009.

5. Current Market Capitalization (317Cr) is close to all time lows for past 4 years (2006-2009 Avg Lowest Market Cap: 270.48Cr)

I would advise strong buy with 50% growth potential (Market Cap: 475Cr) from these levels in the next 6-12 months timeframe. 1-2 year target is 100% appreciation ie. 634Cr

Camlin Fine Chemicals: Long Term Value

Camlin Fine Chemicals. BSE: 532834

Current Market Price: Rs 102

Market Capitalization: 59.22Cr

Sales March 2009: 100Cr, ROCE: 19.02, Total Debt: 26.2Cr

This is a stock I have been recommending for quite some time (when it was in mid 50). It has run up sharply and is now close to its lifetime highs. We are right now in crossroads, Buy/Sell/Hold the company stock.Sales March 2009: 100Cr, ROCE: 19.02, Total Debt: 26.2Cr

Camlin Fine Chemicals (CFC) is an offshoot of Camlin a well established stationary and art brand in India from 1931. CFC came into existence when the promoters of Camlin were looking for new areas to growth beyond their stationary business. Fine chemicals/Active Pharma Ingredients (API) was identified as future growth area (Two decades back). CFC growth started when Ashish Dhandekar took over responsibilites of the Fine Chemical division of Camlin. With CFC becoming a stable business it was seperated from the parent company on Dec 22, 2006 with majority control to Ashish.

CFC is defined as leading manufacturer & exporter of Bulk Drugs, Fine Chemicals and Food Grade products. It has established itself as 2nd largest manufacturer in the world of food grade antioxidants TBHQ & BHA with 70% market share in India.

Since its inception as an independent company in Dec 2006 the company has made forays into Sucralose, neutrachemicals Glucosamine through acquisition of Sangam laboratories, Speciality chemicals through Chemolutions Chemicals Ltd, Renewable Energy and Consumer durables with Fine Brands. Company has recently announced approval of rights issue.

Suggestion: Promoters have made acquisitions at price close to Rs 80 when the company was established as an independent entity (Link). Company is still in its infancy considering the fact that it was established as an independent firm on dec 2006. Company is trying to increase its business areas by entering into Neutrachemicals, Renewable Energy, Consumer Durables all this will require time to settle and businesses to be profitable. I would advise reduction in holding as market cap. approaches close to 75Cr or when rights issue date is announced.

Dilution in Return on Capital:

- Additional raising of capital

- Foray into new areas like consumer goods (Fine Lifestyle Brands)

- Renewable Energy & specialized chemical (Chemolutions Chemicals Limited)

Long Term Value: Considering the strong promoter's it would however be advisable to hold some stock and accumulate more at lower levels (below 75Cr Market Cap) in the next few years as a long term value proposition.

Monday, June 01, 2009

Gujarat Ambuja Exports: BSE: GAEL : Deep Value

Gujarat Ambuja Exports:

BSE Symbol: GAEL

NSE Symbol: GAEL

CMP: 28.70 Market Cap: 397.76Cr (3977.6 million) Sales TTM = 1631.53Cr (16315.3million)

Gujarat Ambuja Exports is an agro processing company producing value added products for export.

- Company has recently (March 27,2008) set up a 500 tonne per day (364x 500 = 182,000 tonnes per annum) maize processing plant. The processing plant is going to produce value added products such as Sorbitol, Dextrose, Starch, Liquid glucose, Malto dextrine. 2nd largest capacity in India.

- GAEL initiated a buyback of shares at Rs 38 per share and bought back 966,615 shares till Jan 15,2008.

- Company has forex hedging losses in its books worth 32.7Cr as of march 2009.

- Company shares are of face value Rs 2 and divident payout is going to be40% ie 80paisa per share.

- 5.63 % shares (7,791,034) held by Quantum M Ltd as per March 2009.

- 4.25% shares (5,877,060) held by Reliance Growth fund as per March 2009.

GAEL is worth investing at these prices and one can expect a price of about 80 to 100 in 12 to 24 months time frame.

Subscribe to:

Comments (Atom)